MedicalAlertBuyersGuide.org is an independent review site. We may earn compensation from the providers below. Learn More

Financially Surviving Covid-19

As people and governments start to imagine a world without lockdown, we’re questioning what it really means to survive this pandemic. In March of 2020, that may have meant something strictly related to health – would we, or someone we know, catch the disease? But today, we know the repercussions have extended far beyond testing negative or positive for COVID-19. Instead, our psychological, emotional, and financial scars may take slightly longer to heal.

We recently spoke to 1,013 people in the U.S., currently in the throes of some of the financial devastation of the coronavirus. Each respondent shared some of the ways in which they were assisting friends, family, and the elderly. They disclosed some of the costs of their generosity as well as the impact it was having on their future financial outlooks. Though there’s certainly a story of financial hardship embedded in these trying times, they often reveal tales of deeper resilience, friendship, and generosity. Keep reading to see just how the coronavirus is unfolding financially in the U.S., as told by the people living through it.

COVID-19’s Economic Shock

The stage was not well set for the public’s financial success this year. Recent numbers tallied 22 million Americans without jobs due to the pandemic, wiping out the equivalent of ten years of job gains. The Bureau of Labor Statistics revealed the large-scale changes that data is already showing in everything from fatal occupational injuries to worsening productivity costs across industries.

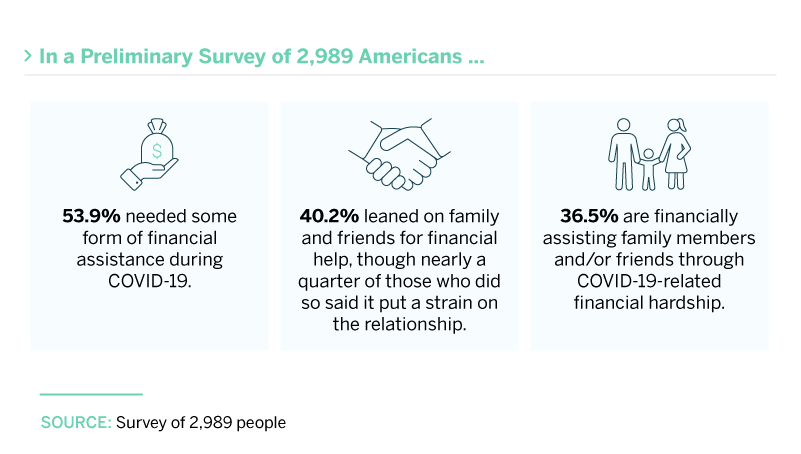

In a preliminary survey of nearly 3,000 Americans, it was discovered that more than half needed financial assistance in some form during COVID-19. Then there’s the emotional strain to consider if a person finds help – over a quarter of those who found that assistance in family or friends said it put a strain on their relationship.

In spite of this lengthy list of hardships, Americans rose to the occasion when the time called for it. At the time of the writing of this article, more than a third were actively giving financial assistance to friends or family experiencing COVID-related hardship. That said, there were even recipients beyond family and friends that Americans were still willing to be generous toward. Continue reading to see what we mean.

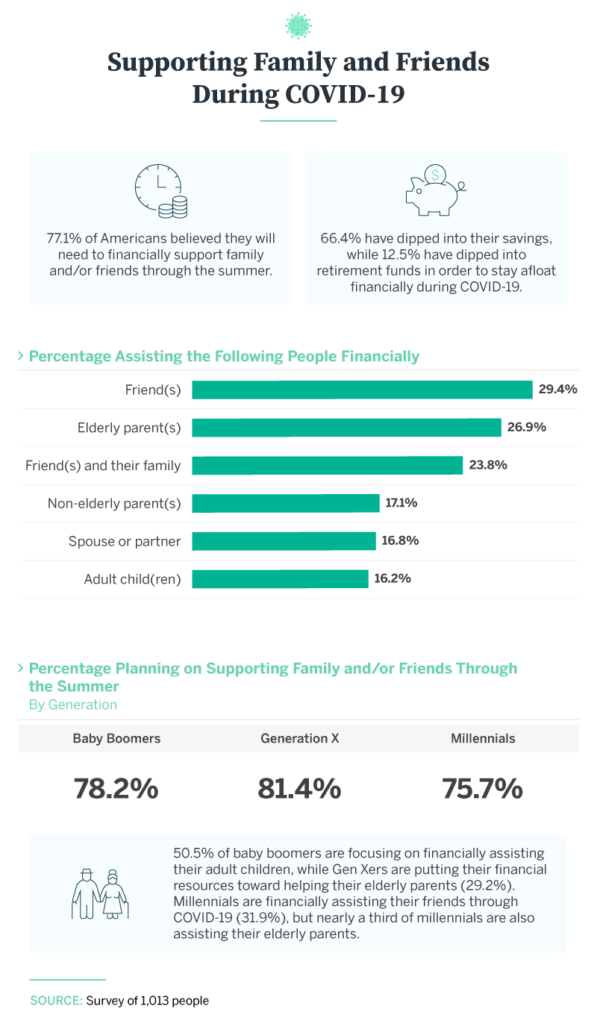

Familial Financial Aid

Recall that in January of 2020, before coronavirus became a word we all know, there were still 78% of Americans living paycheck to paycheck. Once the pandemic took hold, people were forced to look elsewhere. Sixty-six percent had already dipped into their savings in order to stay financially afloat, while 12.5% had taken an expensive step further and dipped into their retirement accounts. Unfortunately, many don’t anticipate financial drains like these to be ending shortly. Seventy-seven percent said they would likely be continuing financial support of family or friends at least through the end of the summer.

Next, our study considered that friends weren’t likely the only ones in need of help, though they were the most likely to receive it. The elderly were actually less likely to be supported financially than friends, in spite of the fact that their medical costs are notoriously expensive – not to mention that those aged 65 and up are most at risk for the virus’s harmful effects.

The burden of financial care was high across all three generations surveyed. Baby boomers, Generation X, and millennials all had at least a 75% chance of anticipating financial support for themselves and others through the end of the summer. That said, millennials (which some financial experts argue have taken the virus’s hardest financial hit) were the most likely to be simultaneously assisting both elderly parents as well as friends. For reference, recall that millennials are currently aged between 22 and 38 years old and often bear more adult responsibilities than the youthful connotation their name suggests.

How They’re Helping

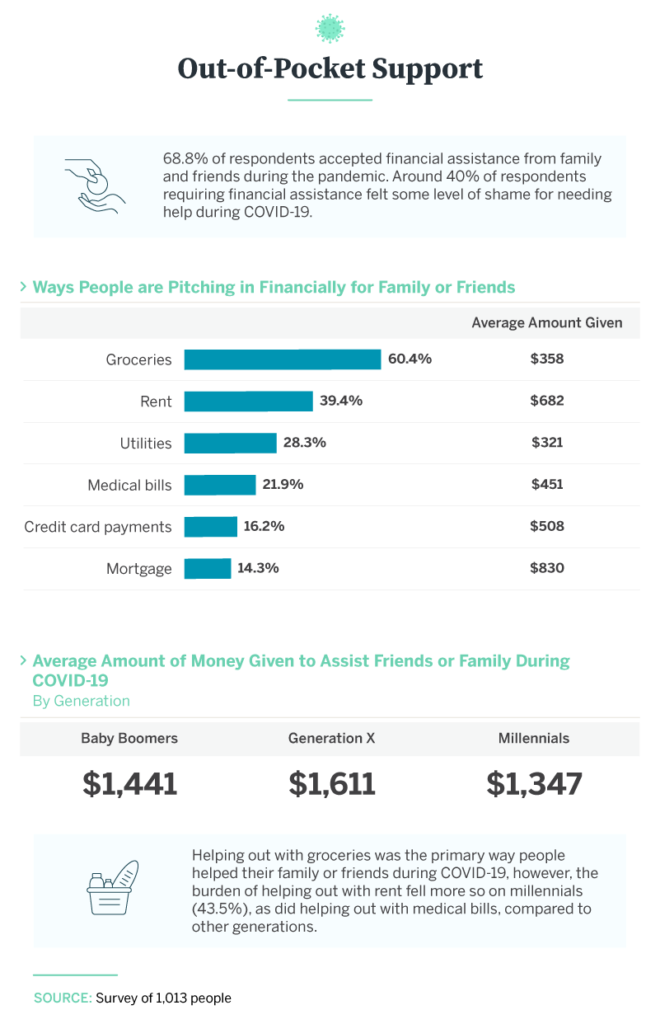

Psychologists often say that it can actually be more difficult to receive than to give. Often, this reluctance to receive can indicate everything from a fear of intimacy to a self-imposed pressure to reciprocate or the fear of seeming selfish. Even though accepting financial assistance was relatively common (68.8% of respondents said they did so), 40% did say they felt shame around the financial aid.

People often did not have the luxury to say no to financial assistance, however; many of the things people were helping out with were true essentials. Most often, people pitched in for groceries (60.4%), rent (39.4%), utilities (28.3%), and medical bills (21.9%). And none of these things came cheap. Help for others’ rents cost respondents $682, on average, while groceries added another $358 to the bill. Mortgages actually cost the most for people to help out with, yet failure to pay the full amounts are still common enough for experts to anticipate an “economic tsunami” because of it. If you find yourself in this category of mortgage-debtors, know there are both private and government-backed relief options available to you.

The highest dollar average amount given by any generation was $1,611, generously offered by Gen X.

Forecasting Finances

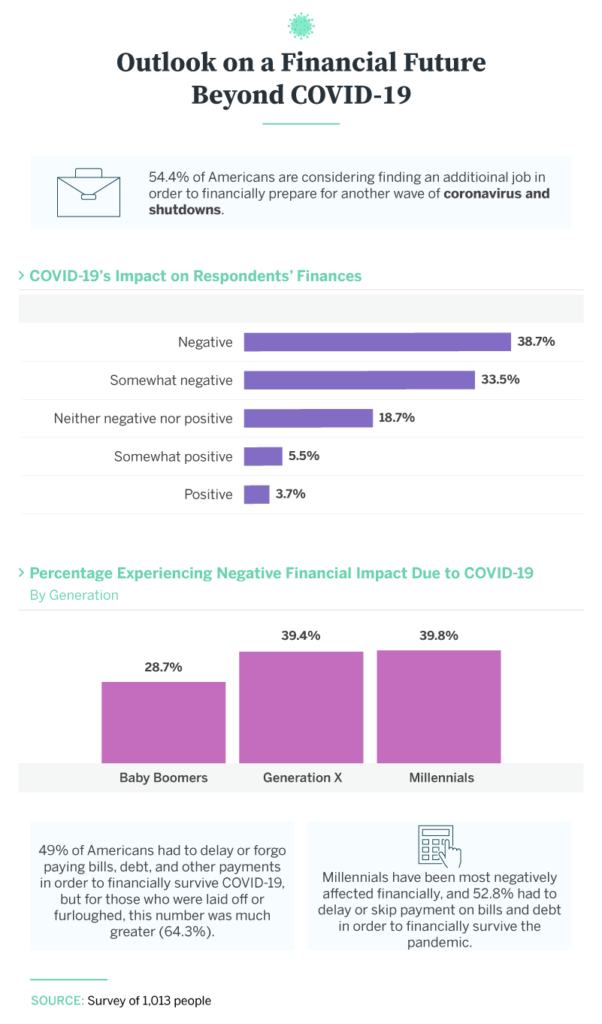

It’s safe to say that negativity was the norm when it came to considering the overall impact the virus had on American bank accounts; most rated the impact as “negative.” Even though generosity and lending a hand can have a positive impact on a person, fewer than 10% were able to say the virus had a remotely positive financial impact.

Generation X and millennials appeared neck and neck when we considered which generation officially had it the worst, financially speaking. Forty percent of millennials and 39% of Gen Xers reported the virus as having a negative financial impact, compared to 28.7% of baby boomers. Fifty-three percent of millennials said they had to delay or skip payments on bills or debt in order to financially survive COVID-19. And of those who were laid off or furloughed, the number forgoing payments grew to 64.3%.

Financial Protection and Hope

The financial strain and struggle presented by the COVID-19 pandemic have been felt intensely by many. The participants in this study were handling everything from groceries to rent for friends and families in spite of obstacles like job loss. Many even dug into their savings and retirement accounts to assist those in need.

To be of the best possible help during these trying times, we’d like to suggest an additional protection for the health and safety of you and your loved ones. Especially if you’re caring for a high-risk individual, you may want to look into buying a device that will alert you to medical problems. Medical Alert Buyers Guide can help you choose the right one. With the most recent available reviews and experts on hand to assist, you can rest assured your safety and the safety of your loved ones is in the best of hands.

Methodology and Limitations

We surveyed 1,013 people who are financially assisting a family member or friend during COVID-19 to explore what sacrifices people are making to help others. We also asked participants to describe the impact that COVID-19 has made on their finances and their outlook on the near future. Respondents ranged in age from 17 to 88 with a mean of 36 and a standard deviation of 12 years. Survey data comes with certain limitations due to self-reporting, which include telescoping, exaggeration, and selective memory. We did not weight data or test our hypotheses.

Fair Use Statement

If you or a loved one could benefit from the financial information regarding COVID-19 that is contained within this article, you are welcome to share. All we ask is that your purposes are noncommercial and that you link back to this page.