MedicalAlertBuyersGuide.org is an independent review site. We may earn compensation from the providers below. Learn More

Covid Financial Security

For nearly an entire calendar year, the world has been living through a global pandemic. In the wake of social distancing recommendations, state and locally mandated shutdowns, and the general fear of health and safety during COVID-19, nearly half of Americans had experienced serious financial impacts in 2020 and 2021.

With record levels of unemployment across the country, 51 million Americans increased their total amount of credit card debt due to COVID-19. Averaging over $90,000 in total debt (or more among some Gen X and baby boomers) many Americans are experiencing financial uncertainty with seemingly no end in sight.

For a closer look at the financial climate in America today, we surveyed over 1,000 people about their debt, and how it’s changed during the pandemic. Read on as we explore where debt is growing; where it may be shrinking; how many people are using their stimulus checks to pay down balances; and how many Americans feel their financial situation has become unmanageable in 2021.

Rating Their Financial Security

Among the more than 1,000 people surveyed, 63% reported feeling somewhat to slightly financially healthy. And while 20% of Americans felt extremely to very financially healthy, another 17% said they weren’t at all financially stable. Among the 1 in 6 financially unhealthy Americans, just 13% were white, compared to their Latino (19%) and Black (25%) counterparts.

Roughly half of Americans (52%) said their debt was as manageable during the pandemic as it was before, but 30% admitted their debt had become less manageable during the COVID-19 crisis. Millennials, among those most likely to experience unemployment along with Gen Z Americans during the pandemic, were also the generation most likely to report having unmanageable debt since the pandemic began. While 22% of people (including 25% of white respondents) said they were able to lower their debt during the pandemic, 36% said their debt stayed the same, and 43% reported having more debt than when the health crisis began. Blacks (46%) and Latinos (44%) were the most likely to report increased levels of debt in 2020.

American unemployment reached an all-time high in 2020, peaking in April at 14.8% and falling in December down to 6.7%. Unemployment was even higher among industries most affected by the pandemic, rising to 39.3% in the leisure and hospitality industry before declining to 16.7% in December. Overwhelmingly, 59% of people who said their debt increased during the pandemic were either furloughed or laid off in 2020.

Changes in Spending Habits in 2020

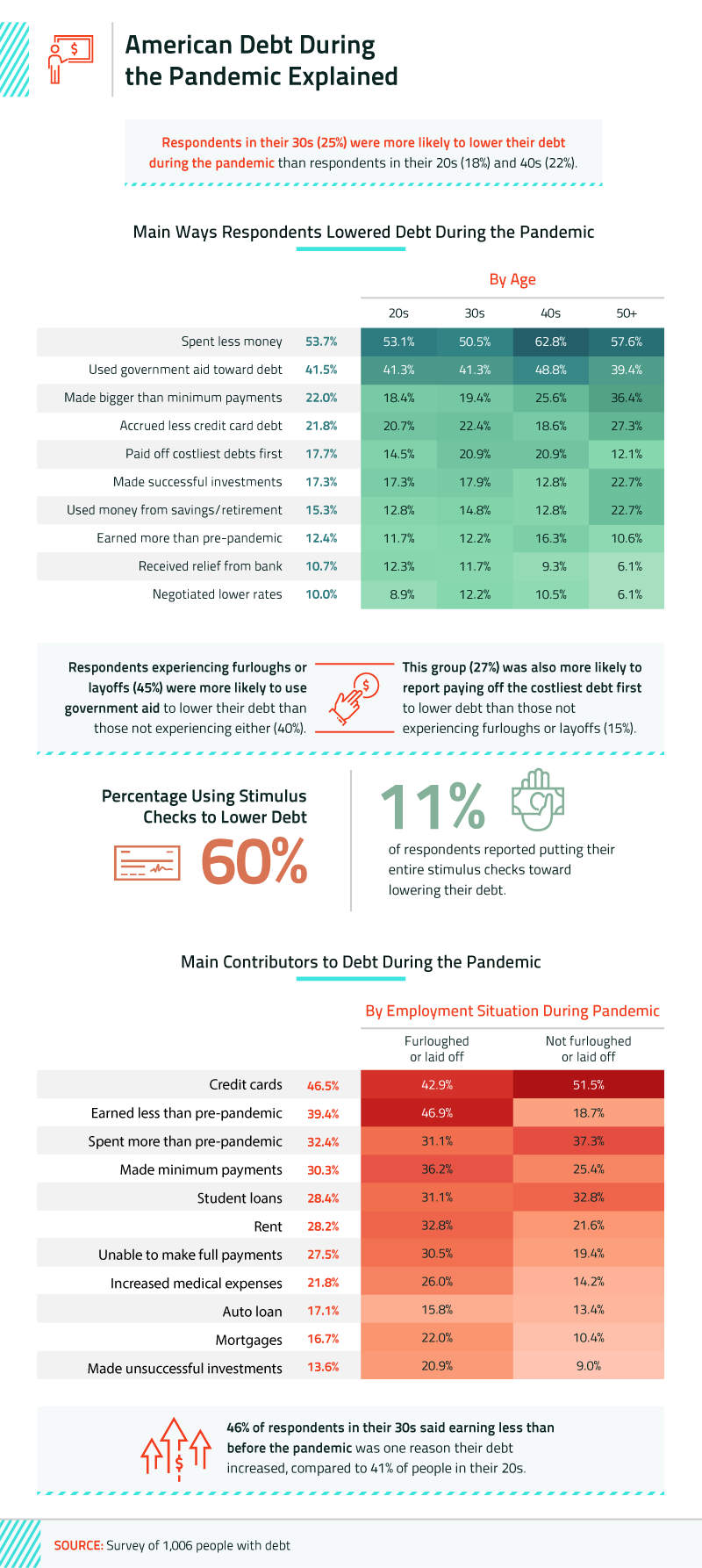

Even while being laid off or furloughed during the COVID-19 pandemic, some Americans were still able to lower their overall debt in 2020. People surveyed in their 30s (25%) were more likely to have less debt than when the pandemic began, compared to those in their 20s (18%) and 40s (22%). Regardless of age, the most common reason people gave for being able to lower their debt was simply spending less money during the pandemic. Without being able to travel or dine out or with less need to spend money on personal care expenses like beauty products or clothing, a vast majority of Americans changed their spending habits in 2020 in one way or another.

Another 42% of people said government aid helped them decrease their debt, including 49% of people in their 40s and 41% of people in their 20s and 30s. People who had been furloughed or laid off were more likely to put government aid toward debt (45%), compared to those not facing unemployment (40%). Overall, 60% of Americans polled acknowledged putting their stimulus checks toward paying off debt. Other ways people were able to reduce debt during the pandemic included making bigger minimum payments (22%), having less credit card debt (22%), and paying off their highest debts first (18%).

Credit card debt (47%), earning less money (39%), spending more (32%), and only being able to make the minimum payments (30%) were the most common contributing factors to increased debt during the pandemic. People in their 30s (46%) were more likely to report having more debt as a result of earning less than before the pandemic, compared to 41% of people in their 20s.

The Impact of COVID-19 on American Finances

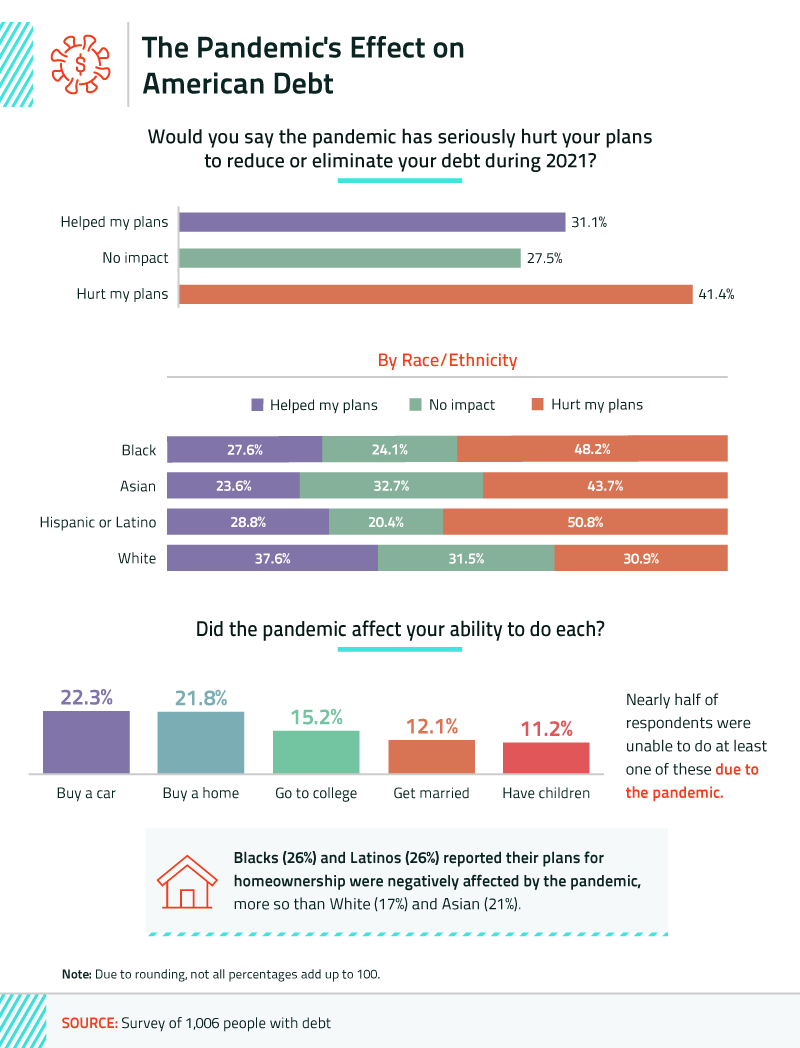

For many, the pandemic has had a negative impact on their ability to reduce debt in the new year, according to 41% of those we polled. However, 31% of people said the pandemic actually aided their plans of lowering or eliminating their debt. That experience wasn’t equally shared when we explored our data by race and ethnicity.

More than any other group, Latinos said the COVID-19 pandemic hurt their plans to reduce or eliminate debt during 2021. While the U.S. economy has been slowly recovering from the worst months in 2020, Black and Hispanic women experienced the slowest changes in unemployment in 2020. One element of this disproportionate economic impact is the higher percentage of Black and Hispanic Americans who work in the leisure and hospitality industry, jobs that often can’t be done remotely and don’t offer paid sick leave for employees. Forty-eight percent of Black respondents also said the pandemic hurt their agenda.

In addition to not being able to pay off their debts, 22% of respondents said the pandemic affected their ability to buy a car, 22% said it affected their ability to buy a home, 15% said it changed their ability to go to college, and 12% said it impacted their ability to get married.

A Light at the End of the Tunnel

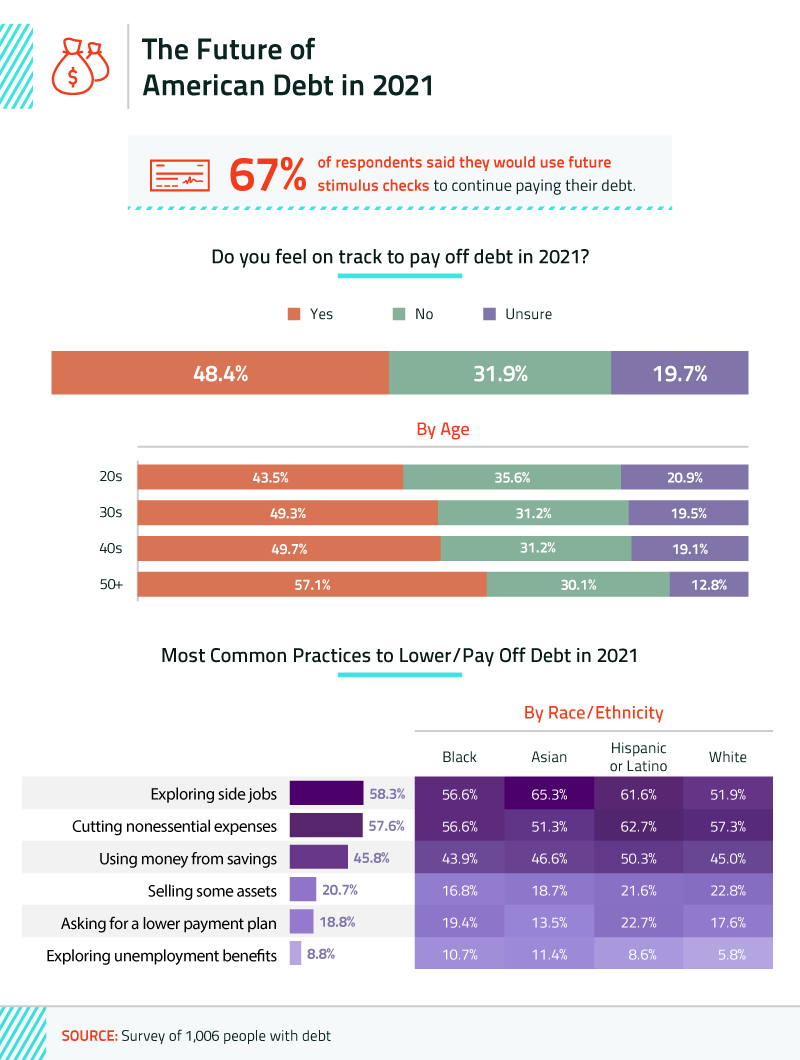

Third stimulus checks are currently being sent through the mail and direct deposit. Even though delivering every payment could take some time, more than two-thirds, 67%, of people surveyed said they would use future stimulus checks to help pay down their debt.

Many people are optimistic about the future. Forty-eight percent of respondents said they feel on track to pay off debt in 2021, and another 20% were unsure. People in their 50s were the most confident about being on the right track (57%), followed by people in their 40s (50%) and 30s (49%). And how are they doing it? Fifty-eight percent of people reported exploring side jobs as an option for lowering or paying off debt in 2021, followed by cutting nonessential expenses (58%), using extra money saved (46%), selling off assets (21%), and asking for a lower payment plan (19%).

Bright Futures Ahead

The economic impact of the COVID-19 pandemic has been bleak, but there is hope on the horizon. Despite record-high levels of unemployment and millions of Americans increasing their total amount of debt in 2020, many of the people we surveyed said they were hopefully (or even confident) about changing their economic situation in the new year. Whether by reducing their spending or picking up a side hustle to create additional revenue streams, nearly half of people said they were on track to pay off debt in 2021.

COVID-19 has given us much to worry about, but worrying about your family members at home shouldn’t be one of them. At Medical Alert Buyers Guide, we know exactly how important it is to care for the most vulnerable people in your life. Your parents or grandparents may be getting older, but their independence and self-reliance may be more important now than ever before. With expert opinions on the best medical alert systems in 2020, including smartwatches and in-car systems, we’ve narrowed down our favorite solutions to help keep your loved ones safe. Explore the best medical alert products, GPS trackers, and discounts on safety products online at MedicalAlertBuyersGuide.org today.

Methodology and Limitations

We surveyed 1,006 people who currently had debt. Fifty-two percent of respondents were men, and 48% were women. The average age of respondents was 37. They were grouped into age groups as follows:

-20s: 340

-30s: 343

-40s: 157

-50s and older: 133

We excluded those younger than 20:

-18-year-olds: 13

-19-year-olds: 20

Respondents identified as the following:

-White or Caucasian: 362

-Asian: 199

-Black or African American: 199

-Hispanic or Latino: 191

-Other: 55

For short, open-ended questions, outliers were removed. To help ensure that all respondents took our survey seriously, they were required to identify and correctly answer an attention-check question.

These data rely on self-reporting by the respondents and are only exploratory. Issues with self-reported responses include, but aren’t limited to, the following: exaggeration, selective memory, telescoping, attribution, and bias. All values are based on estimation.

Fair Use Statement

Are your readers concerned about their finances in 2021? Share the insights from our survey for any noncommercial use with the inclusion of a link back to this page as credit to our incredible team of contributors, without whom these findings would not be possible.