MedicalAlertBuyersGuide.org is an independent review site. We may earn compensation from the providers below. Learn More

Better or Worse Off Than Our Parents?

When it comes to success, many of us hope and expect to be better off than our parents. While experts predict millennials will struggle more financially than their parents, success doesn’t always look the same for everyone, and it won’t always encompass money.

To be better off than the generation before you, it’s best to look at the big picture: Money is important, but so are your health and career decisions. So to learn more, we surveyed over 1,000 people about their perceptions of success compared to their parents. Keep reading to see what we found.

You Are Not Your Parents

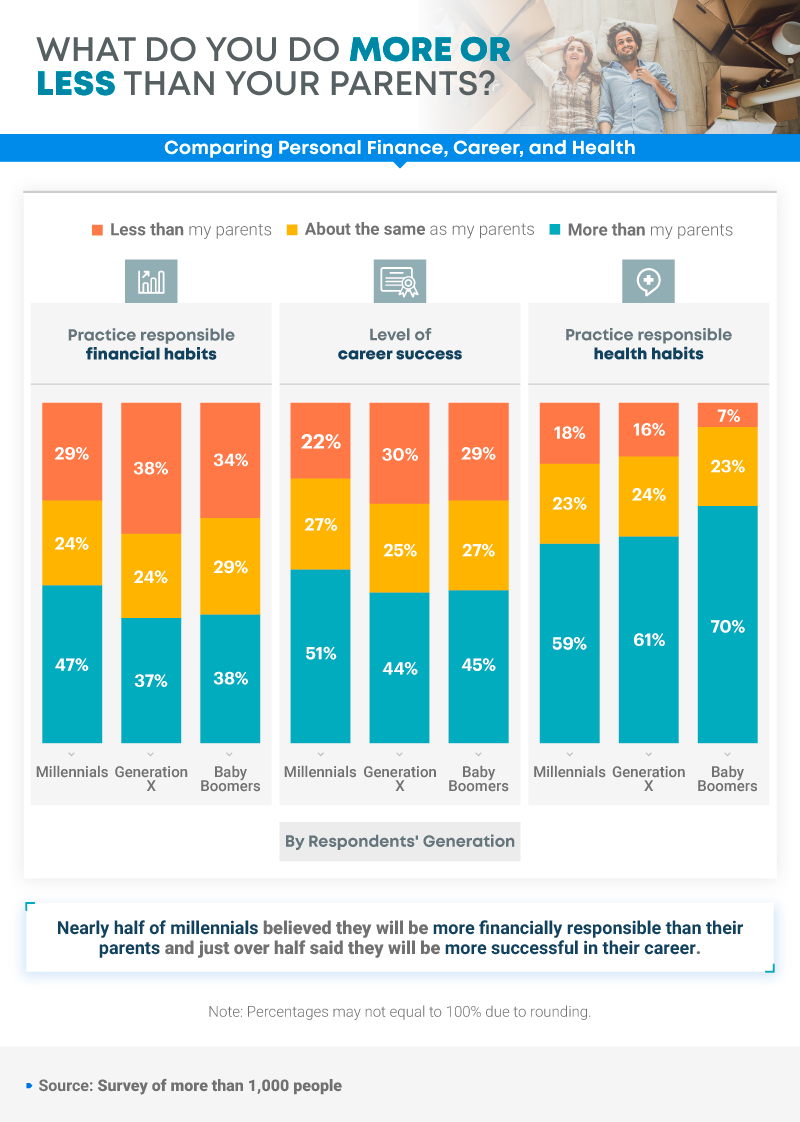

In 2018, Brookings found that the ability to earn more money than previous generations, or absolute mobility, had consistently declined since 1940, disproportionately affecting children from middle-class families. However, success is more than just finances. When you look at your own financial, career, and health habits, in which areas will you be more or less successful than your parents?

While 70% of baby boomers said they practiced more responsible health habits than their parents did, around 50% of millennials believed that they practiced more responsible financial habits and would have greater career success than their parents.

Identifying Financial Mistakes

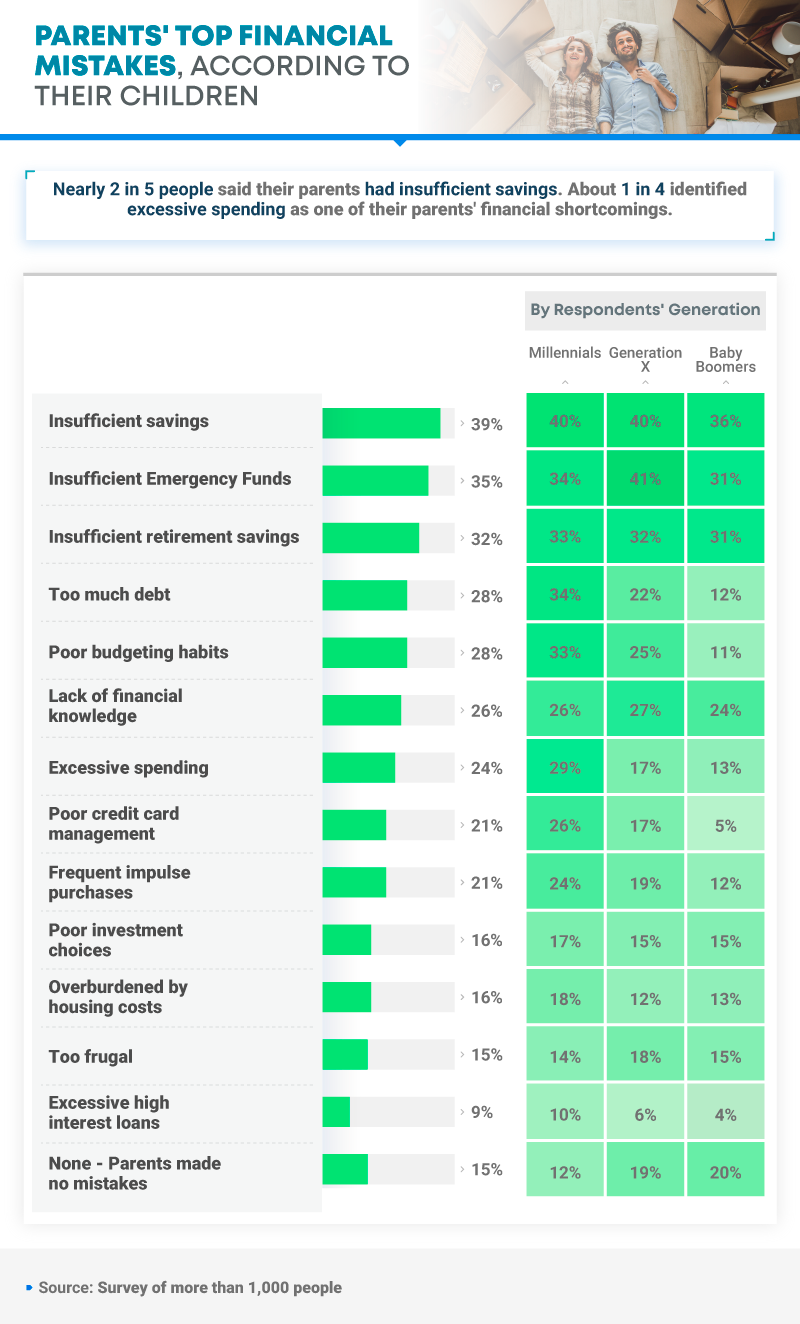

When looking at your financial situation, you might be surprised at the habits preventing you from meeting your goals. It’s important to evaluate where you can improve, but try not to beat yourself up about it. Just like we inherit culinary or cleaning preferences from our parents, we also tend to pick up and emulate the financial decisions made by our parents. Looking at our parents’ money mistakes can help us get on the right track. Millennials and baby boomers said their parents’ biggest challenge was not saving enough money, while Gen Xers cited a lack of emergency funds.

Almost a quarter of respondents said overspending was an issue as well, but millennials are not immune to these mistakes: they tend to lead a lifestyle of spending rather than one of saving. One of the top financial mistakes made by millennials is not saving enough, whether for emergencies or otherwise.

Financial Health Timeline

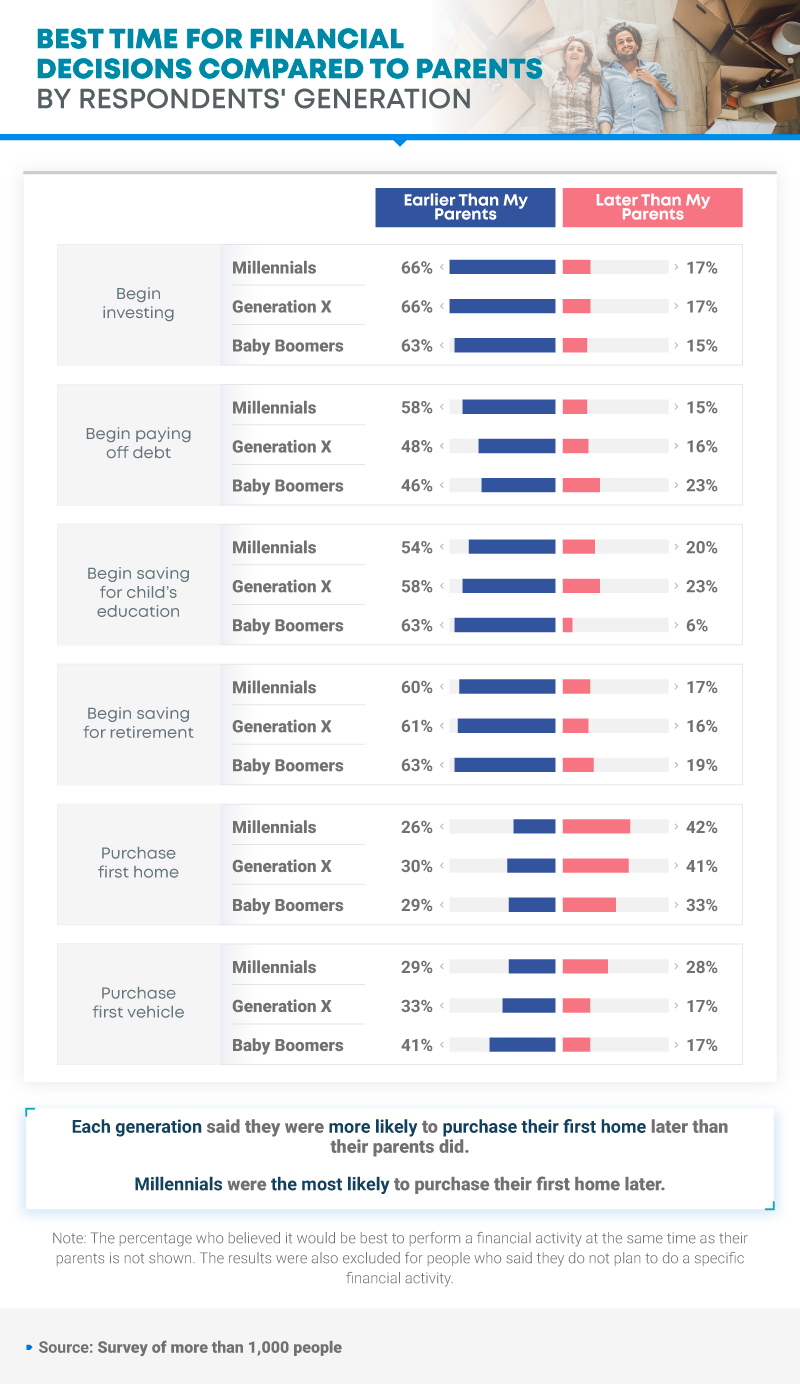

Depending on your generation, you probably have ideas on when to perform certain financial tasks, such as saving for retirement or purchasing a car or home. Millennials and Gen Xers said they expected to invest sooner than their parents, while baby boomers said they began investing, saving for retirement, and putting money away for their child’s education sooner than their parents.

The Urban Institute’s Millennial Homeownership report concluded that millennials are buying homes at a rate of 8 percentage points lower than baby boomers and Gen Xers. Some reasons for this are delayed marriages, increased education debt, and more racial diversity.

Parents’ Career Fumbles

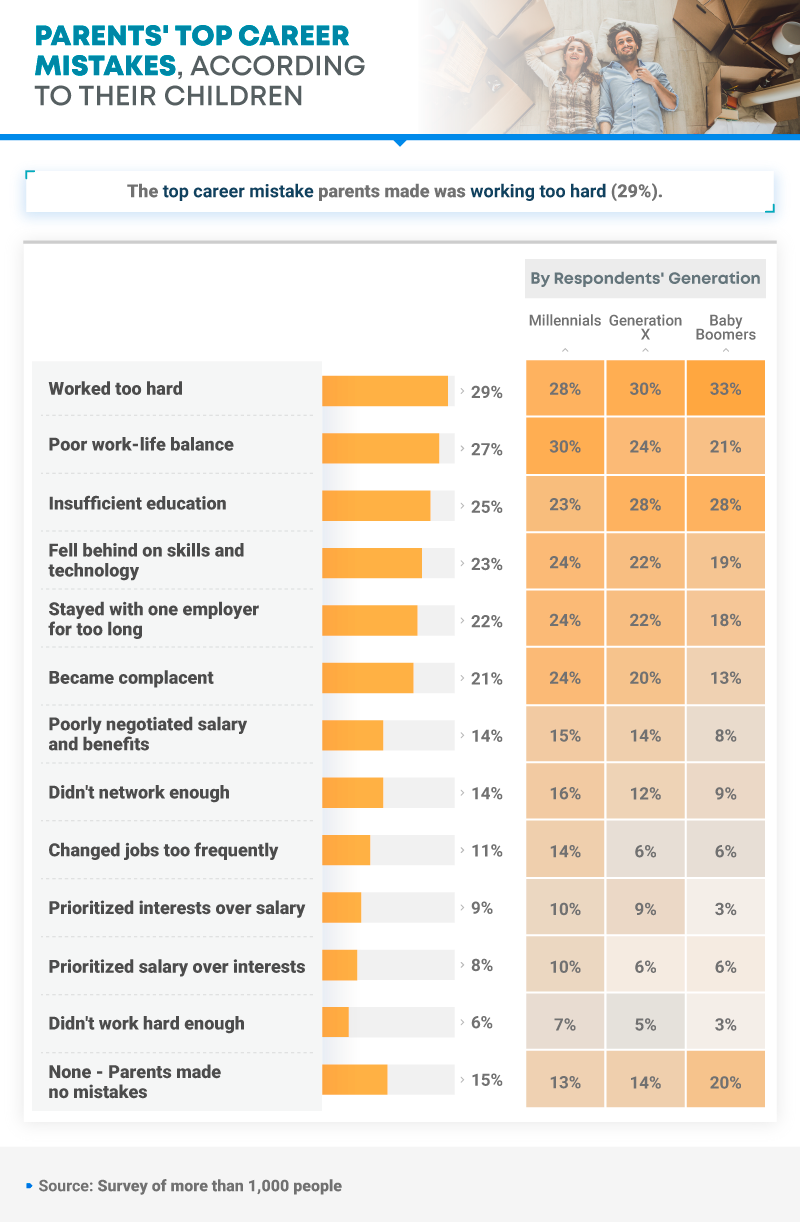

One work value that has changed dramatically in recent years is work-life balance. If you were to ask millennials about their parents’ top career mistake, they would say their parents had a poor work-life balance. But Gen Xers and baby boomers put working too hard at the top of their list. Older generations also were more likely to feel their parents received insufficient education which could possibly be attributed to a lack of education access.

Health as an Investment

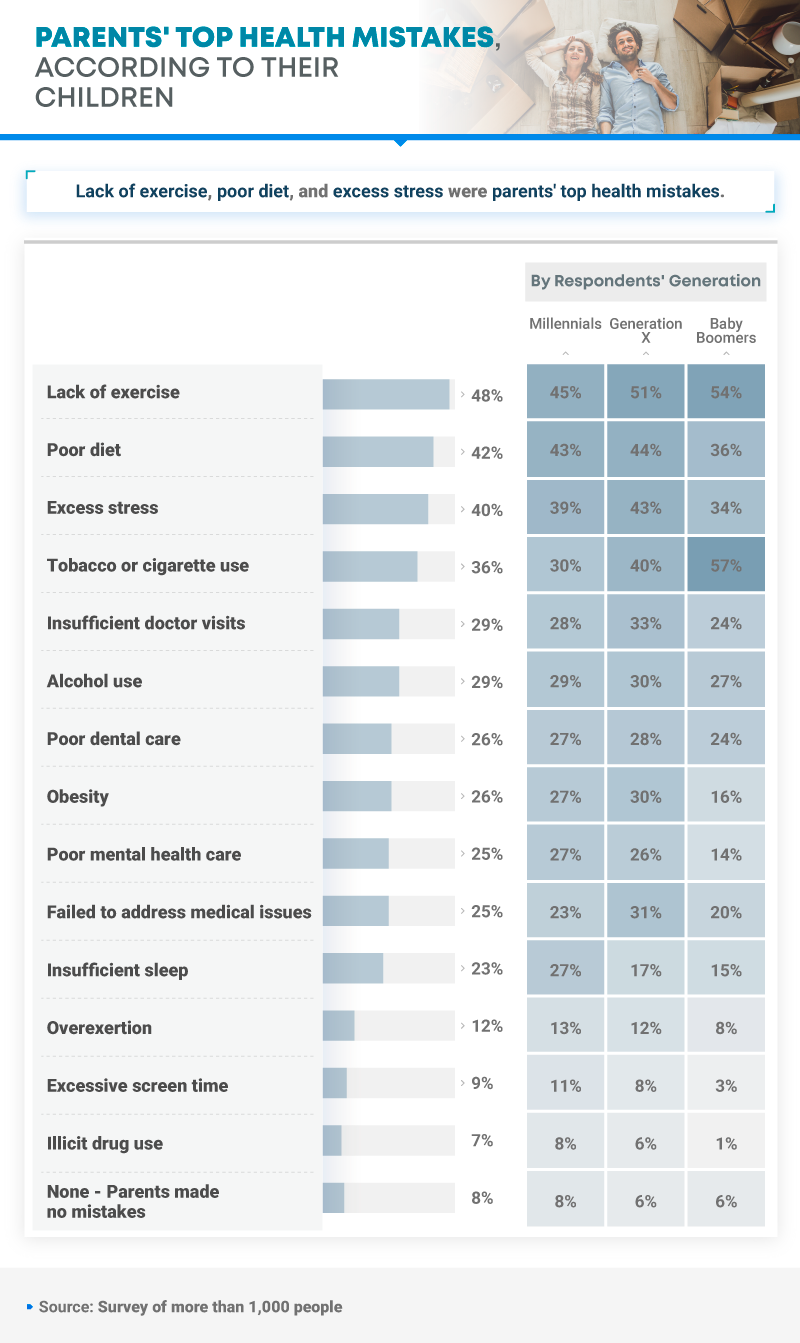

What’s your top health mistake? Unhealthy eating habits? Excessive alcohol or tobacco use? Millennials and Gen Xers identified too little physical movement as their parents’ top mistake, while baby boomers said tobacco use was their parents’ top health mistake. Millennials and Gen Xers also said unhealthy food choices and high stress contributed to their parents’ mistakes.

Following recommended exercise and food protocols can help decrease the incidence of high blood pressure, Type 2 diabetes, mental health issues, and cognitive decline.

Health and Everyday Decisions

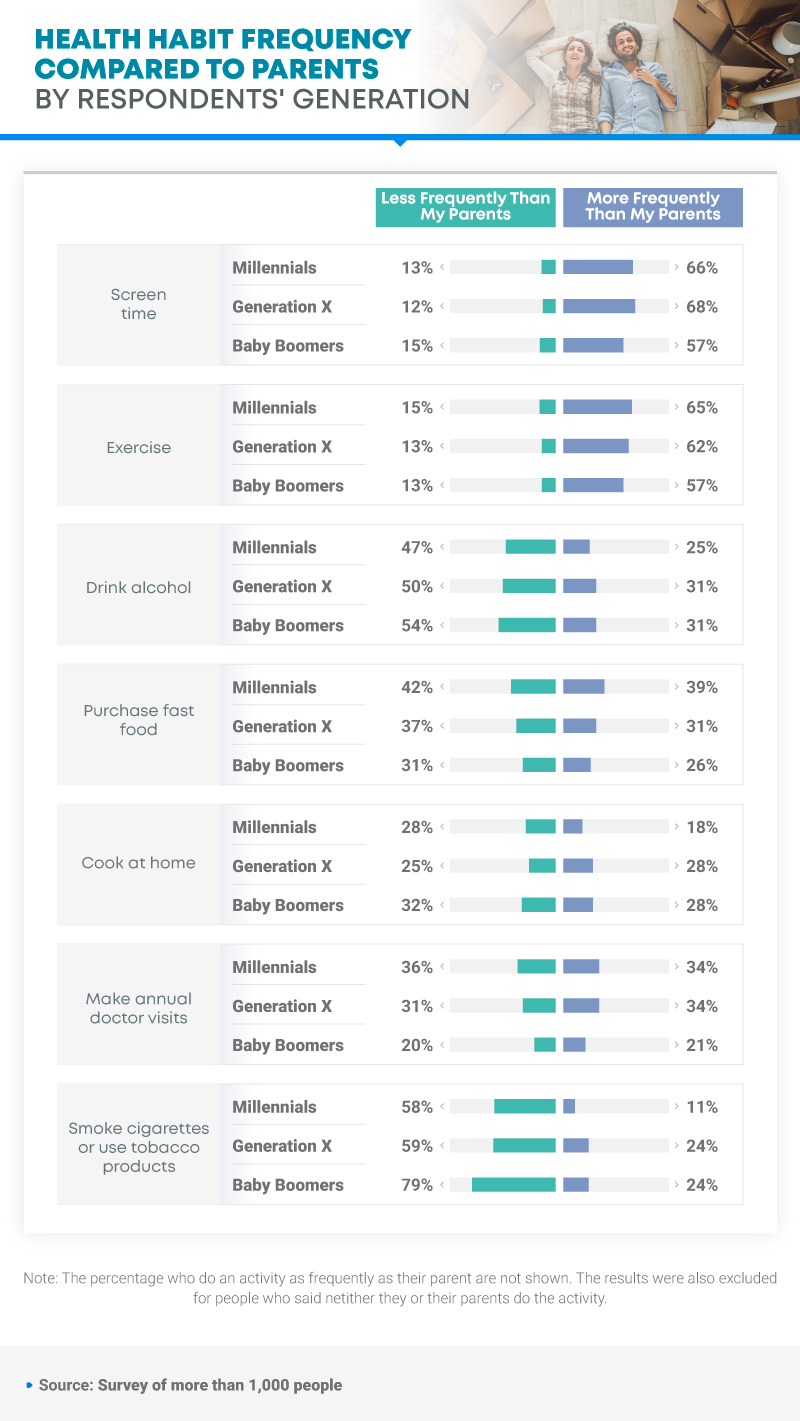

If you consider the ways in which health care and health recommendations have changed over the last 50 years, you might think about how tobacco use was once common or that technology, as it is today, would have been unheard of before the turn of the century. Here, we see that the frequency of certain habits varies significantly by respondents’ generation. For example, only 18% of millennials said they were more likely than their parents to cook meals at home, but 39% said they were more likely than their parents to purchase fast food.

Exercise and screen time were two activities that were much more common today than with previous generations. As well, the percentage of people who used tobacco regularly decreased significantly among baby boomers compared to their parents, compared to Gen Xers and millennials.

Taking Note

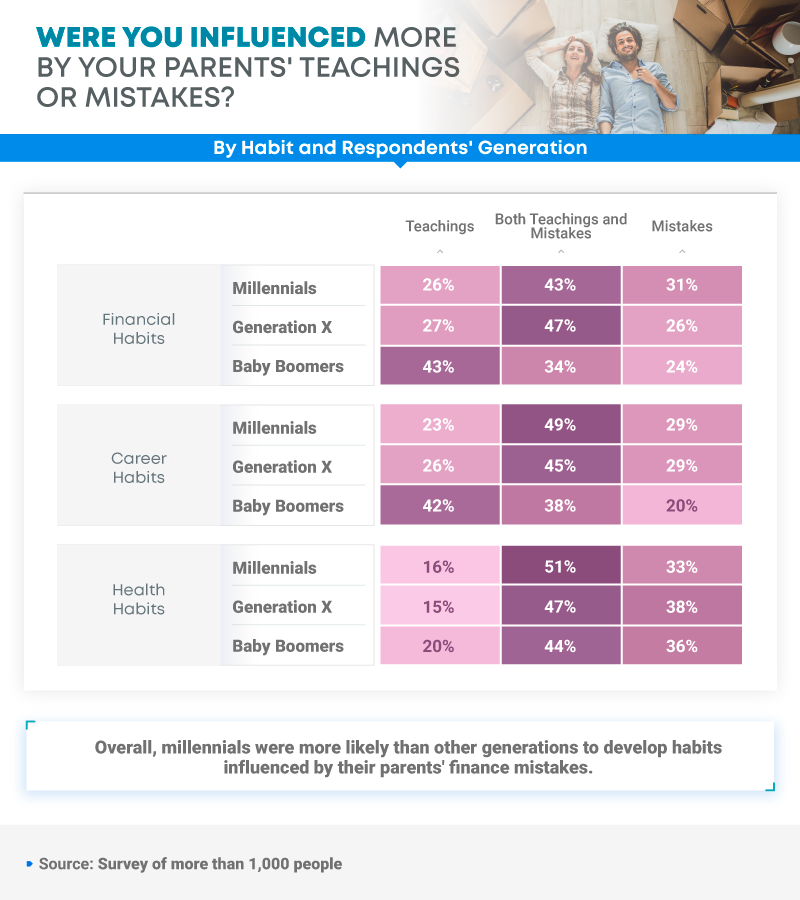

We often learn through instruction and seeing others make mistakes, and this is most likely so with our parents. No parent is perfect, and that provides plenty of opportunities to understand how we can improve.

Making mistakes is part of living a meaningful life, and the lessons we learn, no matter what they’re about, add to who we are as people.

Making Progress

Not falling into the poor habits of our parents can be hard, but every generation has the desire to improve on what their parents did. Success includes finances, but also health and career paths. And as each generation learns and grows, they can identify various ways to be better than those before them.

Let Medical Alert Buyer’s Guide help you make progress in your health goals and habits by utilizing its medical alert system reviews. You’ll be prepared to handle any emergencies that come your way, so you can get back to attending the rest of life’s activities.

Sources

- https://www.cbsnews.com/news/millennials-are-much-poorer-than-their-parents-data-show/

- https://www.brookings.edu/blog/up-front/2018/07/25/fewer-americans-are-making-more-than-their-parents-did-especially-if-they-grew-up-in-the-middle-class/

- https://www.businessinsider.com/millennials-biggest-money-mistakes-saving-credit-2019-4

- https://www.urban.org/urban-wire/state-millennial-homeownership

- https://www.scripps.org/news_items/5475-top-health-concerns-of-baby-boomers

- https://innovationmanagement.se/imtool-articles/embrace-mistakes-as-a-source-of-learning-and-invention/

- http://www.phillipsfinancialstrategies.com/blog/do-you-have-a-timeline-for-your-financial-goals

- https://medschool.ucla.edu/body.cfm?id=1158&action=detail&ref=947

Methodology and Limitations

We collected responses from 1,020 Americans in a survey comparing their personal finance, career, and health habits to that of their parents. Fifty percent of respondents identified as female, 49% as male, and less than 1% as a gender not listed in our study. Fourteen percent of respondents identified as baby boomers (born 1946 to 1964), 23% identified as Generation X (born 1965 to 1980), and 59% identified as millennials (born 1981 to 1997). The remaining respondents identified as Generation Z or as a member of the silent generation.

For baby boomers, our sample size was 143, and the margin of error was 8%. For Generation X, our sample size was 237, and the margin of error was 6%. For millennials, our sample size was 605, and the margin of error was 4%.

Fair Use Statement

Knowing how we can improve in all aspects of life can help us reach our goals. If this information would be beneficial to friends or family, share these findings for noncommercial purposes. But please don’t forget to link back to our website when doing so.