MedicalAlertBuyersGuide.org is an independent review site. We may earn compensation from the providers below. Learn More

Affording Health Care in Retirement

When you imagine yourself retiring, do you envision feeling prepared? More specifically, do you feel ready to take care of your future health needs financially? As Americans begin to experience the economic impacts of the new coronavirus, it can feel like the only certainty is uncertainty.

To explore Americans’ preparedness further, we surveyed 1,006 people who had yet to retire. They shared their expectations for retired life, as well as the steps they had taken to prepare. We also looked at how today’s workforce imagines their future health and what they think they’ll need to maintain it. They even spoke of some changes they hoped to see in the Medicare system and beyond. Continue reading to see what health care in retirement might look like for today’s Americans.

What You’ll Need

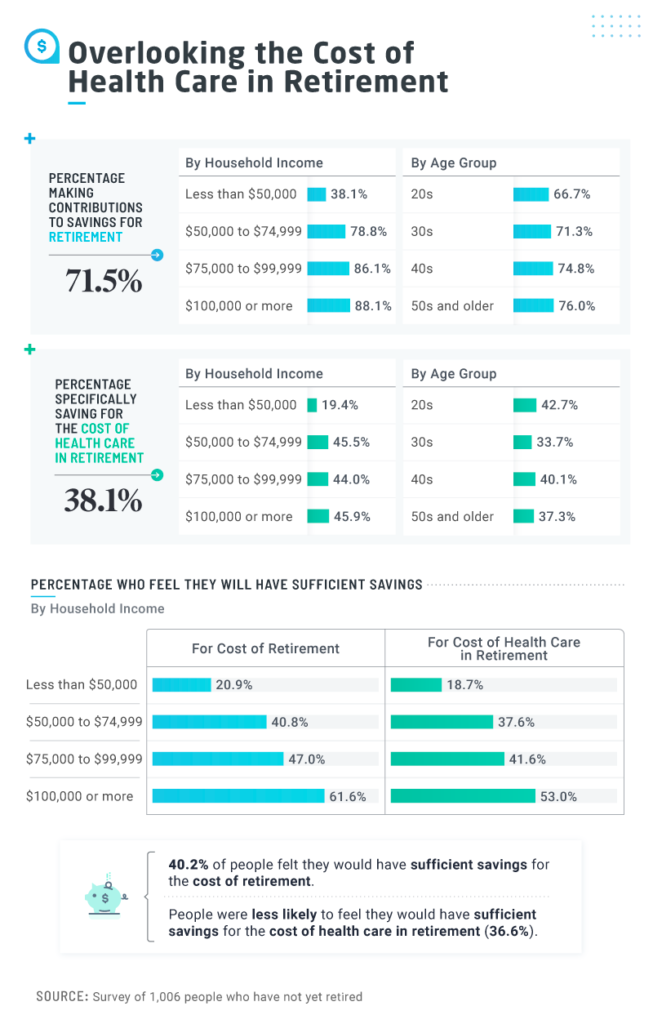

Our study began with a peek into who was saving for retirement and the cost of health care therein. Prior to this study, the statistics from those already retired weren’t encouraging: 64% of Americans were expected to retire broke. Luckily, there’s still time for the future retirees we spoke to.

Even though nearly 72% were contributing to their retirement savings, only 38.1% were saving specifically for the cost of health care, and 40.2% felt they would be financially prepared when the time came to retire. The difference between those preparing for retirement and those preparing for health care suggests that some costs are often overlooked. The average retiree is thought to spend $4,300 on health care each year, although specific conditions and treatments can certainly affect this amount.

Only 20.9% of people earning less than $50,000 said they believed they would have sufficient savings for retirement. Those in lower socioeconomic groups are often impacted negatively by health inequalities that can limit their access to care and increase exposure to various health risk factors. Our study showed that income levels heavily influenced a person’s approach to and outlook of a healthy retirement.

The Payment Plan

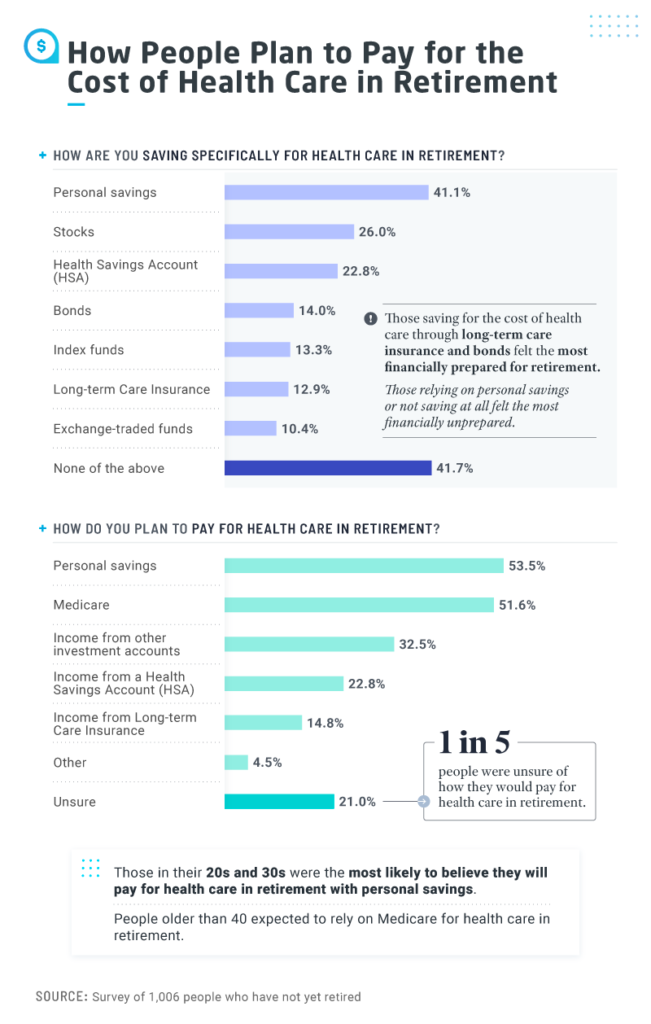

Often, a 401(k) is not enough to cover the full cost of health care in retirement, so we turned our study to focus on alternative methods. The most common saving method respondents chose was personal savings. According to experts, this can be an inefficient strategy, as it prohibits money from earning compound interest available to investors. And yet, around 41% relied on personal savings. Respondents who went this route were also more likely to feel financially unprepared for retirement. Nearly 23% planned to use a health savings account (HSA) – or tax-advantaged account –a relatively more effective option than a personal savings account. The approach of long-term care insurance and bonds, however, correlated with respondents feeling the most prepared financially.

We also asked future retirees how they planned to make health care payments in retirement. Nearly 54% said they were going to use their personal savings, and respondents in their 20s and 30s were even more likely to lean on their savings for future health care costs. Perhaps younger participants have yet to be introduced to compound interest and the necessity of moving money out of savings for higher yields. Almost 52% said they would use Medicare to cover any and all health care costs during retirement.

Although a degree of reliance on Medicare is expected, it’s important to remember that Medicare does not cover everything that a person of retirement age will likely need. For instance, Medicare will not cover the cost of long-term care, most dental care, eye exams for prescription glasses, dentures, and hearing aids, among other things. These expenses will have to be financed personally. Over 1 in 5 people were unsure of what they would do to cover retirement health care costs, and 41.7% said they weren’t saving anything for retired health.

Anticipated Health Concerns

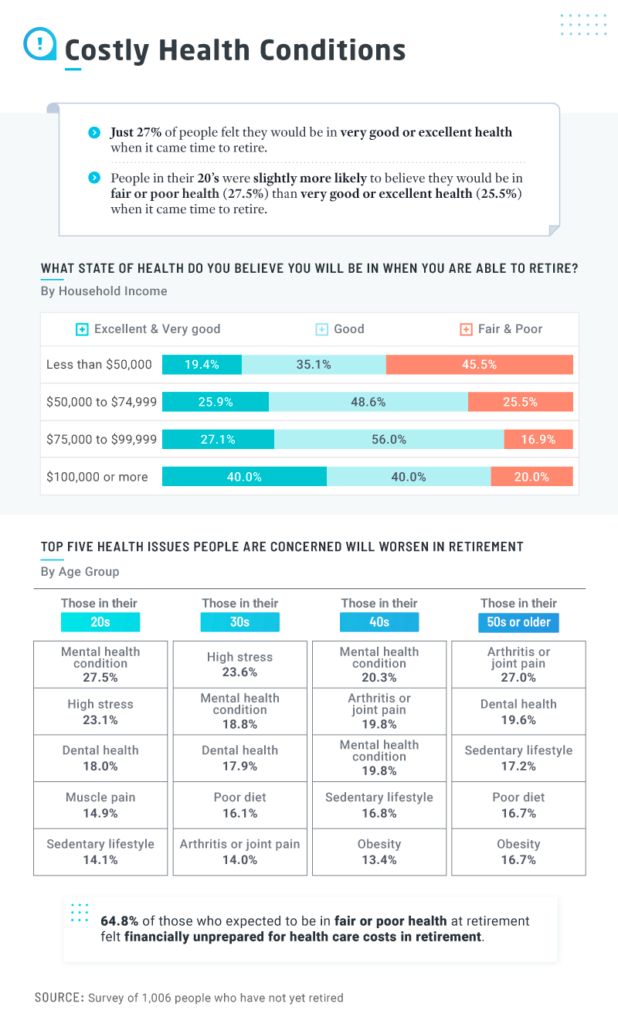

Anticipating future health issues may not be the most uplifting activity, but it could be necessary to estimate how much you’ll need should something happen. Participants were overwhelmingly pessimistic when it came to imagining their health in retirement: Only 27% thought their health would be very good or excellent when it came time to retire. Optimism definitely rose with respondents’ monetary worth, however. Annual incomes of $100,000 or more correlated with a 40% likelihood of anticipating excellent or very good health, while just 19.4% of those earning less than $50,000 each year were able to feel as hopeful. For those living in poverty, even finding the time to go to the doctor can be a stressful ordeal.

When we asked how healthy they thought they would be in retirement, younger participants were more expectant than others of experiencing poor health. Perhaps with retirement further away, it is less scary to admit that youthful health likely wouldn’t last forever. In comparison, older participants may be more reluctant to prescribe to the belief that their health in retirement will likely worsen.

Younger participants were particularly concerned with the future impact of mental health and stress levels in retirement. Respondents closest to retirement age, however, were most concerned with arthritis and joint pain.

Proactive Prevention

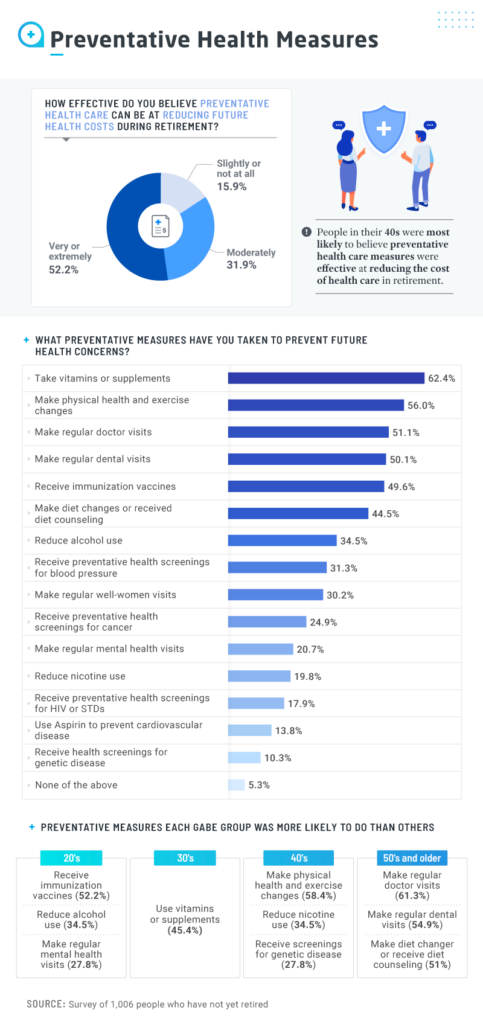

Preventive health care is offered in many health care plans. In fact, all marketplace health plans are required to cover things like blood pressure and cholesterol screenings. But only 52.2% of people trusted that preventive care was extremely effective in reducing future health care costs. While some articles may support this skepticism, many severe illnesses, such as cancer, are known to be easier to treat when caught early.

That said, many of the preventive measures respondents took involved neither their insurance nor their doctors’ offices. For instance, 62.4% took vitamins and supplements, 56% made physical health and exercise changes, 44.5% made diet changes, and 34.5% cut back on alcohol consumption. Poor diets are thought to be one of the main drivers of health care costs in the country, while regular exercise can help to improve the heart conditions that many Americans have when they’re older.

When to Be Ready

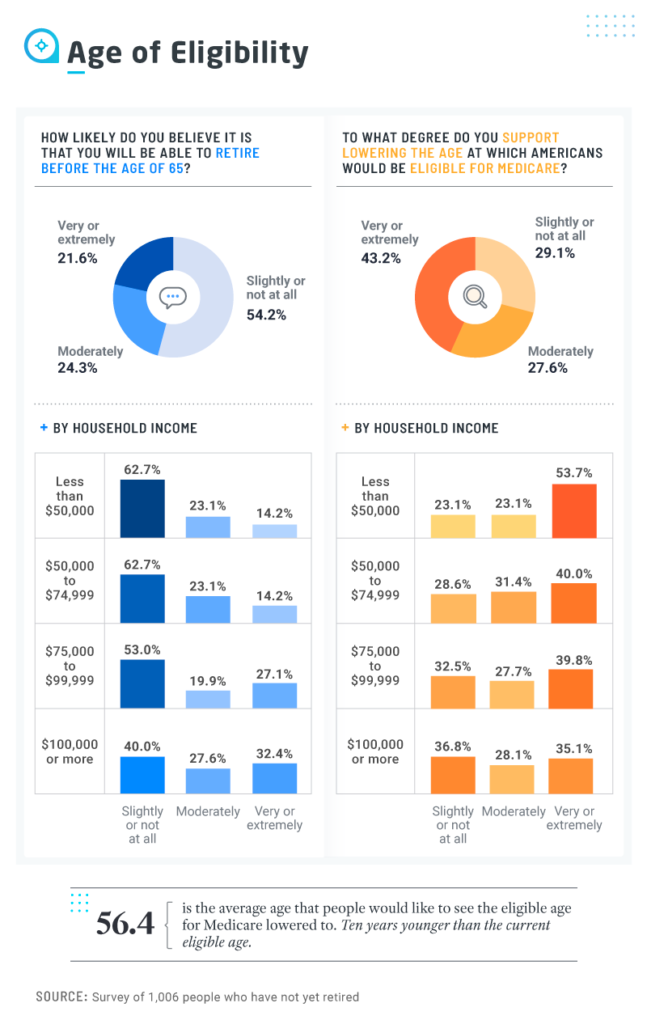

Our study wrapped up with a look at how optimistic people felt regarding their retirement age, as well as what they were hoping for the future of Medicare. Less than a quarter thought it was very or extremely likely they would be able to retire before age 65. It might feel more realistic for households earning $100,000 or more each year, but only 32.4% of these high earners believed they would be able to stop working before they turned 65.

Perhaps we would see the average retirement age drop if the eligible age for Medicare was lowered, as most respondents supported. On average, age 56.4 was thought to be the ideal eligibility requirement for Medicare, although this is 10 years younger than the current eligible age. Lower-income groups, specifically those earning less than $50,000 annually, were even more supportive of dropping the Medicare age. Higher earners were more evenly split.

Ready for Retirement

The data ultimately shows us that a lack of preparation, particularly for the costs of health care in retirement, is more widespread than we thought. Despite the typically high costs of caring for an aging body, many respondents wanted to rely on personal savings or Medicare, which they also hoped would be available to them sooner rather than later. Few took advantage of HSAs, while lower-income households were particularly ill-prepared and even less optimistic about the state of their future health.

The only way to start fixing a problem, however, is acknowledging that there is one in the first place. This study sought to highlight where these problems lie and show us how retirement might be better approached. Preparedness is key, and Medical Alert Buyers Guide is here to help. One of the best ways to take care of your health is to make sure that proper help can be utilized when needed. Head to Medical Alert Buyers Guide to choose the right health alert system for you and your loved ones.

Methodology

We conducted a survey of 1,006 people who had not yet retired. Respondents were then asked to answer questions about their preparedness for the cost of health care during retirement.

Fifty-two percent of our respondents identified as female, 48% identified as male, and less than 1% identified as a gender not listed on our survey. Respondents ranged in age from 18 to 82, with a mean of 39 and a standard deviation of 12.

Limitations

It is possible that with more respondents from each demographic, we may have been able to gain better insight. The findings on this page rely on self-reporting and, as such, are susceptible to exaggeration or selective memory.

No statistical testing was performed. The claims listed above are based on means alone and are presented for informational purposes.

Fair Use Statement

Preparing for retirement is no easy task, but at least people can face it together. Feel free to share this knowledge if you know someone who could benefit from the findings. In doing so, though, you must be sure your purposes are noncommercial and you link back to this page.