MedicalAlertBuyersGuide.org is an independent review site. We may earn compensation from the providers below. Learn More

A Senior’s Guide to Protecting Personal Data Online

The internet has an amazing way of opening doors for seniors. You can chat with your family, take online classes in areas you’re passionate about, and even have a video conferencing doctor’s visit. Online spaces, from virtual learning programs to social media, have the power to make your life richer and much more convenient.

However, doors work both ways. Sometimes it’s a friend checking on your social media to see how the home remodel is going. Other times, you might be attracting more unfriendly attention.

Cybercrime is sharply on the rise. And the most targeted demographic is people over 60, according to the FBI. In 2020, cybercriminals got hold of seniors’ private information, including social security numbers and bank logins, and made off with almost a billion dollars.

The good news is that there’s a lot you can do to protect your personal data. This includes using hard-to-crack passwords, being cautious about the links you click, updating security on your devices and staying on top of the latest scams making the rounds.

Together, these four precautions act like four different locks on your door. Each one keeps criminals away from your information and your money. Let’s take a closer look at these strategies.

Pick Smart Passwords

What do your bank account, your Facebook page, and your healthcare portal all have in common? They contain personal data hidden behind passwords. You’ll want to use strong passwords that are hard for hackers to guess. Smart passwords are:

- not shared. Use a different password for each website.

- long. Aim for at least 12 characters (numbers, letters, and symbols).

- not easily looked up. Don’t use birthdays, relatives’ names, or your street name as a password.

- private. Try not to write your password down. If you must, don’t leave the paper out where somebody could read it.

However, a username and password might not be enough to protect your most important information. For extra peace of mind, see if you can turn on 2-factor authentication with any sites that have your banking or credit card numbers. With this system, you put in your password and as a second step, a unique, temporary code is sent to your phone by text or voice. That code unlocks your most important data.

Check Before You Click

One major way that cybercriminals get your information is by tricking you into downloading a file or clicking on a fake link. If you get an email that sounds a little strange, don’t click on anything. If your bank is asking you to log in, don’t access it through the email. That message may be sending you to a convincing-looking fake site. Once you type your password into the login page, the scammers have it.

Another area to be careful with is your web browser itself. Do you ever check the little box to let your browser remember your password? Do you keep website cookies enabled? Cybercriminals who manage to break into your web browser can get to your information, along with that of thousands of other users. Yes, it is an extra step to type passwords in and close pop-ups every time you visit. It’s also safer.

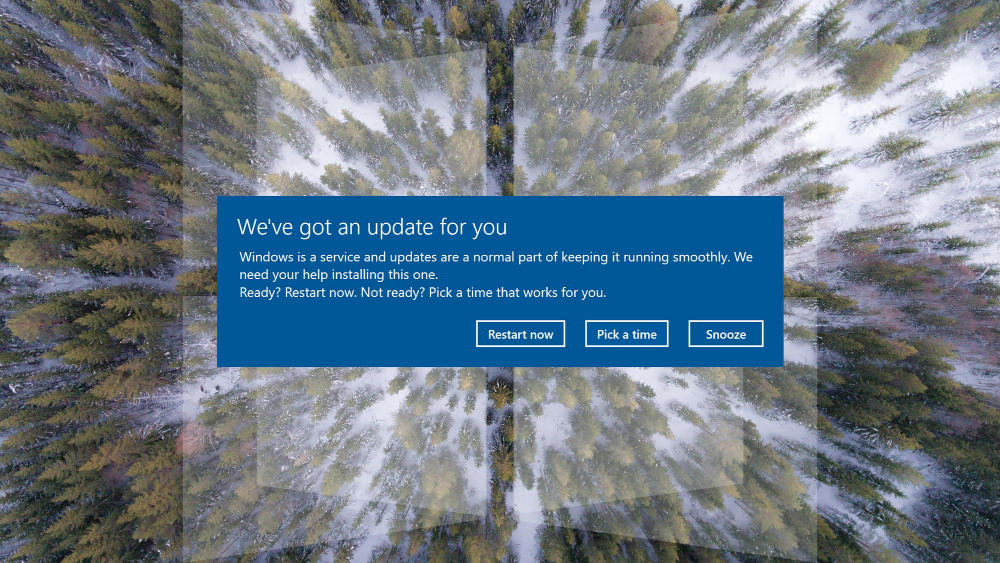

Don’t Skip Those Updates

Legitimate companies, from Amazon to your email provider, are constantly working to fix holes in their security and thwart cybercriminal tactics. When an app or a program on any of your devices says there’s an update available, let it run. This will help shore up your lines of electronic defense against the bad actors on the internet.

What if it’s been a while since you were prompted to update? A setting could have gotten turned off. Try manually searching to see if there’s an update available. You may be able to do that through a menu on your phone. For your computer or tablet, you might need to recruit a friend or family member to help.

Be Scammer Savvy

Not every criminal steals your password to break into your account. Some of them talk you into willingly handing over your information and your money. They used to do this over the phone. Now that so many seniors are on the internet, these cybercriminals have branched out to email and social media schemes.

Scammers have many tricks up their sleeves. Some will pretend to be a grandchild or friend who’s in trouble and desperately needs money now. Others say that you’ve won the lottery and they’ll send the prize over if you give them your bank info now. Certain people claim they gave you items or services and they’ll sue you unless you pay up now.

Seeing a trend? Most scammers try to raise your emotions and put a time pressure on you. After all, if you think things through, you’ll see through their lies.

How can you recognize a scam fast? Educate yourself on what angle these criminals are playing. The Fraud Watch Network from AARP can help you stay abreast of the latest scams and data breaches. If you think you’ve been targeted, they have a helpline you can call. You can also report suspicious online activity to the FBI.

Smart Choices Keep You Cyber-Safe

Cybercriminals target seniors over other age groups, but they can’t do anything without your passwords and other private information. Keep their fingers off your personal data by setting up smart passwords, avoiding suspicious links, updating your programs, and staying educated on the scams they try to pull.